All Articles

Accident Investigation & Reconstruction

Law Enforcement

Accounting

Logistics - Reverse Logistics

Architecture

Machinery

Audio Forensics

Manufacturing

Automotive - Vehicular

Marine - Maritime

Banking

Mediation

Branding - Brand Management

Medical Malpractice

Business Management

Medical Records Review

Computer Forensics

Medicine

Computers

Mining

Criminology

Neuropsychology

Crisis Management

Oil & Gas

Digital Forensics

OSHA

Discovery & Electronic Discovery

Pain Management

Economics

Plants & Trees

Electrical - Electrocution

Plastic / Reconstructive / Cosmetic Surgery

Enterprise Resource Planning (ERP)

Product Liability

Environment

Professional Skills

Forensic Psychiatry

Psychology

Forgery & Fraud

Public Speaking

Hazardous Materials

Recreation & Sports

Insurance Coverage Analysis

Risk Management

Intellectual Property

Spirituality

Land Mapping - Surveying - Zoning

Telecommunication

Land Use

Warnings & Labels

More...

INSURANCE-PAGE ARTICLES MAIN PAGE

. Contact Us if you are interested in having your work published on our website and linked to your Profile(s).

All Articles

Accident Prevention & Safety

International Trade

Alcohol, Tobacco & Other Drugs

Internet Marketing

Archaeology - Archeology

Land Mapping - Surveying - Zoning

Architecture

Law Enforcement

Audio Forensics

Machinery

Automotive - Vehicular

Mediation

Bacteria - Fungus - Mold Investigation

Medical - Medicine

Branding - Brand Management

Medicine

Construction

Metallurgy

Cosmetology: Hair / Makeup

Nonprofit Organizations

Damages

Oil & Gas

Dental - Dentistry

Patents

Digital / Crypto Currency

Premises Liability

Digital Forensics

Psychology

Documentation Examination & Analysis

Public Speaking

Economics

Radiology

Employment

Real Estate

Expert Witnessing

Search Engine Optimization (SEO)

Eyewitness Testimony

Sexual Abuse - Molestation - Harassment

Fires & Explosions

Slip, Trip & Fall

Food & Beverage

Speech-Language Pathology

Foot / Ankle Surgery

Taxation

Human Resources

Terrorism - Homeland Security

Injury

Warnings & Labels

Insurance

Workplace Violence

More...

Featured Articles

There are no active articles here at this time. Please use the search bar, try another category, or contact us if you would like to contribute an article.

This Article is unavailable. Contact Us

Search articles by title, description, author etc.

Sort Featured Articles

Featured resources

Starting a Nonprofit: 5 Things Every...

by Jessica Birken, MNM, Esq.

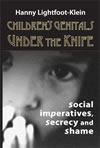

Children's Genitals Under The Knife:...

by Hanny Lightfoot-Klein

Valuing a Business (4th Edition)

by Shannon P. Pratt, Robert F. Reilly, Robert P. Schweihs

Follow us