11/25/2009· Damages

Lost Inventory and Lost Profits Damage Formulas in Litigation

This article arose from an actual litigation. To protect the identity of the parties, I usefictional names.

By: Dr. Stanley Stephenson & David A. MacPherson

As Originally published in Journal of Business Valuation and Economic Loss Analysis, 2006 - Volume 1, Issue 1

Tel: 800-479-2341

Email Dr. Stephenson

Survival risk of new businesses is a challenging issue to incorporate into lost profits analyses used in litigation, an issue some financial experts and courts ignore rather than consider explicitly. This paper considers several ways to make qualitative and quantitative adjustments for the survival rates of new businesses. The paper concludes firm-specific modeling of survival rates is the most appropriate way to weight future economic returns because it offers the best alternative in terms of fitting the analysis to the facts of the case and doing so in a credible and clear manner.

The likelihood of survival by a new business is an overarching factor in consideration of lost profits yet this topic has been largely unexplored. New businesses, historically considered "unestablished" businesses, previously were unable to recover lost profits or even lost value of the entire business due to the "new business rule"; namely, courts considered profit claims for such businesses speculative due to lack of operating history. Over time, legal standards for new business lost profits have moved away from the dichotomous new business rule to a standard based more on reasonable proof of damages. Still, lacking much if any operational history, especially profitable operations, means estimating damages for new businesses is still problematic for legal and economic reasons; moreover, evidence of future viability of the new business becomes an important factor. This paper offers and evaluates four qualitative and quantitative ways to adjust lost profits damages for survival: (1) qualitative approaches using factor lists, including factors which may be associated with higher or lower cost of capital; (2) quantitative approaches which rely on survival averages of cohorts of new firms; (3) quantitative approaches which use survival averages of subgroups of firms in (2); and (4) quantitative survival adjustments using empirical studies of new firm survival and matched characteristics of the target business.

A new business can experience damages for several reasons, including breach of contract, business interruption due to a fire, flood, earthquake or other natural disaster, intellectual property infringement, death or injury to a "key" person, or other cause of actions and the courts have increasingly allowed lost profits as a part of damages to such businesses. As several authors have noted, especially Dunn (2000) and Lloyd (2002) the current and developing standard used by courts puts the emphasis on evidence in consideration of reasonable certainty of lost profits by the new businesses. Included in this evidence are factors such as (1)-(3) plaintiff's experience before and after the damaging event and plaintiff's experience at other locations; (4) lost customers; (6) defendant's experience; and (7) industry and economic factors, including the experience of others in the same industry, market, and location. Survival evidence is also needed.

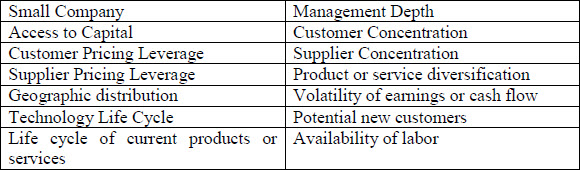

One way for the valuation consultant to "adjust" for new business survival is to list and analyze a number of factors which might reasonably bear on survival. This might include the seven factors listed above regarding the reasonable certainty of any profits. In addition, one might refer to components associated with specific risk factors in computing a risk adjusted cost of equity capital. This list includes the following components:

The list is suggestive and not all factors may apply to the target business. Also, there is some debate as to exactly how best to use this particular list. For instance, Hitchner and Vogt offer three suggestions in the context of cost of capital analysis: assign specific values to each component, score each as + or - or NA, or just provide a summary risk factor for the entire list. Lloyd offers a similar list when discussing firm survival and also suggests consideration of cash flow, the quality of company records, the economic milieu in which the business operates, third- party information on the target company, and non-economic factors such as possible willingness of self-employed owners to accept lower than expected income due to possible advantages of self employment.

Exactly how the damages expert makes qualitative adjustments for survival is case-specific. One possibility, that implied by Hitcher and Vogt (2005) involves an analysis leading to a greater (or lower) company-specific risk factor as a component in the cost of capital used to discount future lost profit damages; but that is not the only way to surface survival as a factor. The point is the qualitative approach to survival adjustments for a new firm is largely a judgment call by the expert and sometimes the line between legal and economic views may not be that clearly defined. For these reasons it is important to consider quantitative adjustments to survival, especially methods which include some of the qualitative factors associated with survival of a new business.

A number of articles address new firm survival and the impression one gets from these is most new businesses fail within a few years after start up, thus possibly reinforcing the traditional new business rule used by some courts that lost profits in such firms are indeed speculative. For instance,

An implication of this research for litigation involving lost profits or business value of a start up is to weight lost profits by average survival rates found in the studies above; this is a second approach to survival-adjusting lost profits for new businesses. Yet, is it appropriate to multiply economic returns by the overall average likelihood of survival to derive expected economic returns? To address this question calls for a more detailed analysis of each source.

. . .Continue to read rest of article (PDF).

Stanley P. Stephenson, Ph.D. Economics, has provided Economic Litigation services in more than 300 cases. His experience includes Business Valuations, Economic and Quantitative Analysis and Market Assessments.

©Copyright - All Rights Reserved

DO NOT REPRODUCE WITHOUT WRITTEN PERMISSION BY AUTHOR.

11/25/2009· Damages

Lost Inventory and Lost Profits Damage Formulas in Litigation

This article arose from an actual litigation. To protect the identity of the parties, I usefictional names.

11/25/2020· Damages

Attaining Reasonable Certainty in Economic Damages: What Constitutes Best Evidence (Part III of III)

By: Michael Pakter

The purpose of this article - the third of three (Part I and Part II) on this topic - is to provide the reader with an understanding Chapter 3 (What Constitutes Best Evidence) of the 2018 Practice Aid as well as certain other publications containing a body of knowledge on the best evidence to support economic damages in a court of law

3/20/2017· Damages

Use of the Internet and social media has become an increasingly essential element of conducting business in the United States and globally, which in turn raises new issues for calculating damages and performing valuations. With almost every business now using the Internet and social media to conduct business, cases of Internet IP infringement, IP misuse, and defamation have increased and evolved. Before the rise of these new media, cases of infringement and defamation typically occurred in print or on television and were visually obvious.