expert witnesses

Business Damages Analysis Expert Witnesses: 28

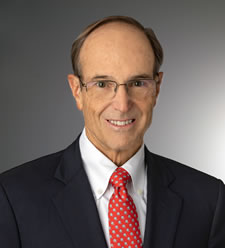

Forensic Valuation Expert Witness Curtis Kimball

Curtis R. Kimball, CFA, ASA

Senior Managing Director

430 Vinewood Point

Marietta GA

30068

USA

phone: 404-475-2307

Damages and Forensic Accounting Experts WZWLH

Barbara Luna, PhD, CPA

Senior Partner

See Multiple Addresses Below

CA USA

phone: 818-981-4226

fax: 818-981-4278

Economic Damages Expert Jules Kamin

Jules Kamin, MA (Econ), MBA, PhD

President

Los Angeles CA USA

phone: 323-653-9555

fax: 323-653-5391

Forensic Accounting Expert Richard Teichner

Richard M. Teichner

Providing Services Nationally

Offices in Reno and Las Vegas shown at the bottom

NV

USA

phone: 775-828-7474

fax: 775-201-2110

Satellite Media Telecommunication Valuation Expert Witness Armand Musey

J. Armand Musey

President

49 West 38th Street

12th Floor

New York NY

10018

USA

phone: 212-433-4800

Financial Economist Consultant Stan Smith

Dr. Stan V. Smith

President & Founder

1165 N. Clark Street, Suite 600

Chicago IL

60610-2845

USA

phone: 312-943-1551

fax: 312-943-1016

Economic Damages Expert Witness Sidney Blum

Sidney P. Blum, CPA, CFE, CPEA, CFF

2017 CA - CPA of the Year

Los Angeles and San Francisco

Los Angeles and San Francisco CA USA

phone: 818-631-3192 or 510-570-646

Personal Injury Loss Experts RPC

Dr. Ronald T. Luke, JD

President

6300 La Calma Drive, Suite 170

Austin TX

78752

USA

phone: 512-371-8166

fax: 512-371-8001

Hospitality Management Expert Witness Dennis Gemberling

Dennis P. Gemberling, CHA, CFBE, FMP, FCSI

President and Founder

201 Mission Street, Suite 1200

San Francisco CA

94105

USA

phone: 800-580-3950

fax: 800-398-4660

Business Valuation Expert Witness Nolte Analytics

Brian Nolte, CPA, ABV

Founder

700 S. Flower St.

Suite 1000, #57

Los Angeles CA

90017

USA

phone: 213-315 -2700

Intellectual Property Expert Witnesses Nevium Intellectual Property Consultants

Doug Bania, CLP, Founding Principal

See Multiple Addresses Below

CA USA

phone: San Diego 858-255-4361 Los Angeles 310-975-3145

Golf Expert Richard Singer

Richard Singer

Senior Director of Consulting Services

501 N. Highway A1A

Jupiter FL

33477

USA

phone: 561-744-6006

fax: 561-744-9085

Insurance Damages Expert Witness Key Coleman

Key Coleman

Executive Director and Founder

Serving Clients Nationwide from Greater Philadelphia

Drexel Hill PA

19026

USA

phone: 215-779-5452

Forensic Accounting Expert Witness William Legier

William R. Legier, CPA, CFE, CFF

1100 Poydras Street, 34th Floor

New Orleans LA

70163

USA

phone: 504-599-8300

Forensic Accounting Expert Witnesses Keegan Linscott Associates

Christopher Linscott, CPA, CFE, CIRA

3443 N Campbell Avenue, Suite 115, Tucson, AZ 85719

USA

phone: 520-884-0176

fax: 520-884-8767

Featured resources

by Sajid Khan, MD

by Michael T. Motley, PhD

by Emanuel Kapelsohn

Follow us

Curtis R. Kimball, CFA, ASA, is an experienced Financial Valuation Analyst and the national director for WMA’s Wealth Management Valuation Practice. Mr. Kimball works with the firm’s regional, national, and international clients out of WMA’s Atlanta regional office, which he opened in 1995. He has been valuing private company interests and restricted interests in public companies, intellectual properties, and other intangible assets, rights, claims, and investments for a variety of purposes for over 40 years.

Curtis R. Kimball, CFA, ASA, is an experienced Financial Valuation Analyst and the national director for WMA’s Wealth Management Valuation Practice. Mr. Kimball works with the firm’s regional, national, and international clients out of WMA’s Atlanta regional office, which he opened in 1995. He has been valuing private company interests and restricted interests in public companies, intellectual properties, and other intangible assets, rights, claims, and investments for a variety of purposes for over 40 years. J. Armand Musey, CFA, JD/MBA, founder and president of Summit Ridge Group, LLC, provides expert witness testimony for the Telecom, Media, and Satellite Industries. Mr. Musey is a highly regarded financial analyst with expertise in Asset Valuation, Business Valuation, Financial Analysis of Economic Damages, and Financial Scenario Analysis.

J. Armand Musey, CFA, JD/MBA, founder and president of Summit Ridge Group, LLC, provides expert witness testimony for the Telecom, Media, and Satellite Industries. Mr. Musey is a highly regarded financial analyst with expertise in Asset Valuation, Business Valuation, Financial Analysis of Economic Damages, and Financial Scenario Analysis.

Dennis Gemberling, CHA, CFBE, FMP, FCSI, President and Founder of Perry Group International, has over 35 years of experience in the Hospitality Management industry. His experience includes managing, operating, and consulting on full-service, limited-service, extended-stay, all-suite, condo and timeshare hotels and resorts, casual, fine-dining, and quick-service restaurants, bars and nightclubs, catering and special event facilities, casinos, and mixed-use real estate.

Dennis Gemberling, CHA, CFBE, FMP, FCSI, President and Founder of Perry Group International, has over 35 years of experience in the Hospitality Management industry. His experience includes managing, operating, and consulting on full-service, limited-service, extended-stay, all-suite, condo and timeshare hotels and resorts, casual, fine-dining, and quick-service restaurants, bars and nightclubs, catering and special event facilities, casinos, and mixed-use real estate.  Doug Bania, CLP, Founding Principal

Doug Bania, CLP, Founding Principal Christopher G. Linscott, CPA, CFE, CIRA, is a Director of Keegan Linscott & Associates and is the Director of Litigation, Forensic Accounting, and Bankruptcy Support Services.

Christopher G. Linscott, CPA, CFE, CIRA, is a Director of Keegan Linscott & Associates and is the Director of Litigation, Forensic Accounting, and Bankruptcy Support Services.