expert witnesses

Directors and Officers Liability Expert Witnesses: 15

Damages and Forensic Accounting Experts WZWLH

Barbara Luna, PhD, CPA

Senior Partner

See Multiple Addresses Below

CA USA

phone: 818-981-4226

fax: 818-981-4278

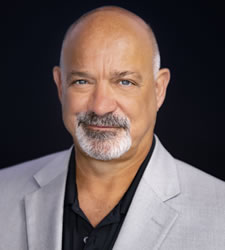

Finance Damages Expert Witness Max Holmes

Max Holmes

Expert Witness / Investor / Lawyer / NYU Stern Professor

46 Milbank Avenue, Suite 102

Greenwich CT

06830

USA

phone: 203-302-1750

Securities Software Compliance Expert Witness David Tilkin

David Tilkin

Mr

164 Central Street

Hingham MA

02043

USA

phone: 781-836-4643

FINRA Compliance Expert Witness Thomas Selman

Thomas M. Selman, CFA

President & CEO

1221 Woodside Parkway

Silver Spring MD

20910

USA

phone: 914-296-4346

Financial Market Derivatives Expert Witness James Lovely

1102 S. Florida Avenue

Lakeland FL

33803

USA

phone: 863-398-9898

Insurance Expert Witness Lezlee Liljenberg

Lezlee Liljenberg, CIC, CRIS, MLIS, PA, MA

6612 Martha's Vineyard Drive

Arlington TX

76001

USA

phone: 817-999-2463

Securities Financial Regulation Expert Witness Braden Perry

Braden M. Perry, Attorney at Law

2000 Shawnee Mission Parkway, Suite 210

Mission Woods KS

66205

USA

phone: 816-527-9445

fax: 855-844-2914

Commercial Banking Expert Witness Jay Hibert

Jay Hibert

Principal Expert

2600 La Costa Ave

Carlsbad CA

92009

USA

phone: 760-518-2310

Property Casualty Insurance Expert Witness Scott Margraves

Scott S. Margraves, CIC

11 Bayou Pointe Dr

Houston TX

77063

USA

phone: 713-416-9000

Professional Liability Insurance Expert Witness Frederick Fisher

Frederick J. Fisher

Professional Liability Consultant

214 Main Street, Ste. 181

El Segundo CA

90245

USA

phone: (310) 426-2105

fax: 310-356-3355

Property Casualty Insurance Expert Witness David Bano

David A. Bano

626 Avenida de Mayo

Sarasota FL

34242

USA

phone: 614-519-5389

Insurance Expert Witness Wayne Citron

Wayne Citron

Insurance Expert

6 Carter Dr.

Marlboro NJ

07746

USA

phone: 800-248-7661 or 732-972-9500

Financial Planning Ethics Expert Witness Marguerita Cheng

Marguerita Cheng, CFP®, CRPC®, RICP®

Chief Executive Office

9841 Washingtonian Blvd. #200

Gaithersburg MD

20878

USA

phone: 301-502-5306

Nonprofit Organizations Expert Witness Jess Birken

Jessica Birken

Attorney & Owner

1400 Van Buren St. NE

Suite 200

Minneapolis Minnesota

55413

USA

phone: 612-200-3679

Financial Expert Norman Katz

Kelly Zinser

Principal

1278 Glenneyre Street

Ste. #454

Tustin CA

92651

USA

phone: 949-263-8700

fax: 949-263-0770

Featured resources

by Jim Geier

by Daniel A. Strachman

by Donald H. Godi, FASLA, RCA, et al

Follow us

Max Holmes has over 40 years of experience in Finance as a portfolio manager, research analyst, board member, lawyer, NYU Professor and expert witness.

Max Holmes has over 40 years of experience in Finance as a portfolio manager, research analyst, board member, lawyer, NYU Professor and expert witness. David Tilkin is a Litigation Support and Expert Witness specialist with over 40 years of experience in the Securities Industry and over ten years of experience in the Compliance Software Industry. Mr. Tilkin has been providing litigation and expert witness services at varying degrees since 2000 when he left First Union Securities to start Protegent.

David Tilkin is a Litigation Support and Expert Witness specialist with over 40 years of experience in the Securities Industry and over ten years of experience in the Compliance Software Industry. Mr. Tilkin has been providing litigation and expert witness services at varying degrees since 2000 when he left First Union Securities to start Protegent. Lezlee Liljenberg, CIC, CRIS, MLIS, PA, MA, entered the Insurance business in 2004 as she started her first agency from ground zero, growing the business to over $6 million in revenue in less than 12 years.

Lezlee Liljenberg, CIC, CRIS, MLIS, PA, MA, entered the Insurance business in 2004 as she started her first agency from ground zero, growing the business to over $6 million in revenue in less than 12 years.

Scott S. Margraves, CIC, has over 32 years of Commercial Property and Casualty Insurance experience. He is the Principal Consultant and Founder of Gulf Coast Risk Management, LLC (GCRM). GCRM provides research, analysis and advice to commerce, industry, government and individuals.

Scott S. Margraves, CIC, has over 32 years of Commercial Property and Casualty Insurance experience. He is the Principal Consultant and Founder of Gulf Coast Risk Management, LLC (GCRM). GCRM provides research, analysis and advice to commerce, industry, government and individuals.  Marguerita M. Cheng, CFP®, CRPC®, RICP®, Chief Executive Officer at Blue Ocean Global Wealth, is a Certified Financial Planning Expert with 18 years of experience. Prior to co-founding Blue Ocean Global Wealth, she was a Financial Advisor at Ameriprise Financial and an Analyst and Editor at Towa Securities in Tokyo, Japan. Ms. Cheng is a past spokesperson for the AARP Financial Freedom Campaign and a regular columnist for Investopedia & Kiplinger. She is a CFP® professional, a Chartered Retirement Planning CounselorSM, a Retirement Income Certified Professional® and a Certified Divorce Financial Analyst. As a Certified Financial Planner Board of Standards (CFP Board) Ambassador, Ms. Cheng helps educate the public, policymakers, and media about the benefits of competent, ethical financial planning. She served on the Financial Planning Association (FPA) National Board of Directors from 2013 – 2015 and is a past president of the Financial Planning Association of the National Capital Area (FPA NCA).

Marguerita M. Cheng, CFP®, CRPC®, RICP®, Chief Executive Officer at Blue Ocean Global Wealth, is a Certified Financial Planning Expert with 18 years of experience. Prior to co-founding Blue Ocean Global Wealth, she was a Financial Advisor at Ameriprise Financial and an Analyst and Editor at Towa Securities in Tokyo, Japan. Ms. Cheng is a past spokesperson for the AARP Financial Freedom Campaign and a regular columnist for Investopedia & Kiplinger. She is a CFP® professional, a Chartered Retirement Planning CounselorSM, a Retirement Income Certified Professional® and a Certified Divorce Financial Analyst. As a Certified Financial Planner Board of Standards (CFP Board) Ambassador, Ms. Cheng helps educate the public, policymakers, and media about the benefits of competent, ethical financial planning. She served on the Financial Planning Association (FPA) National Board of Directors from 2013 – 2015 and is a past president of the Financial Planning Association of the National Capital Area (FPA NCA).